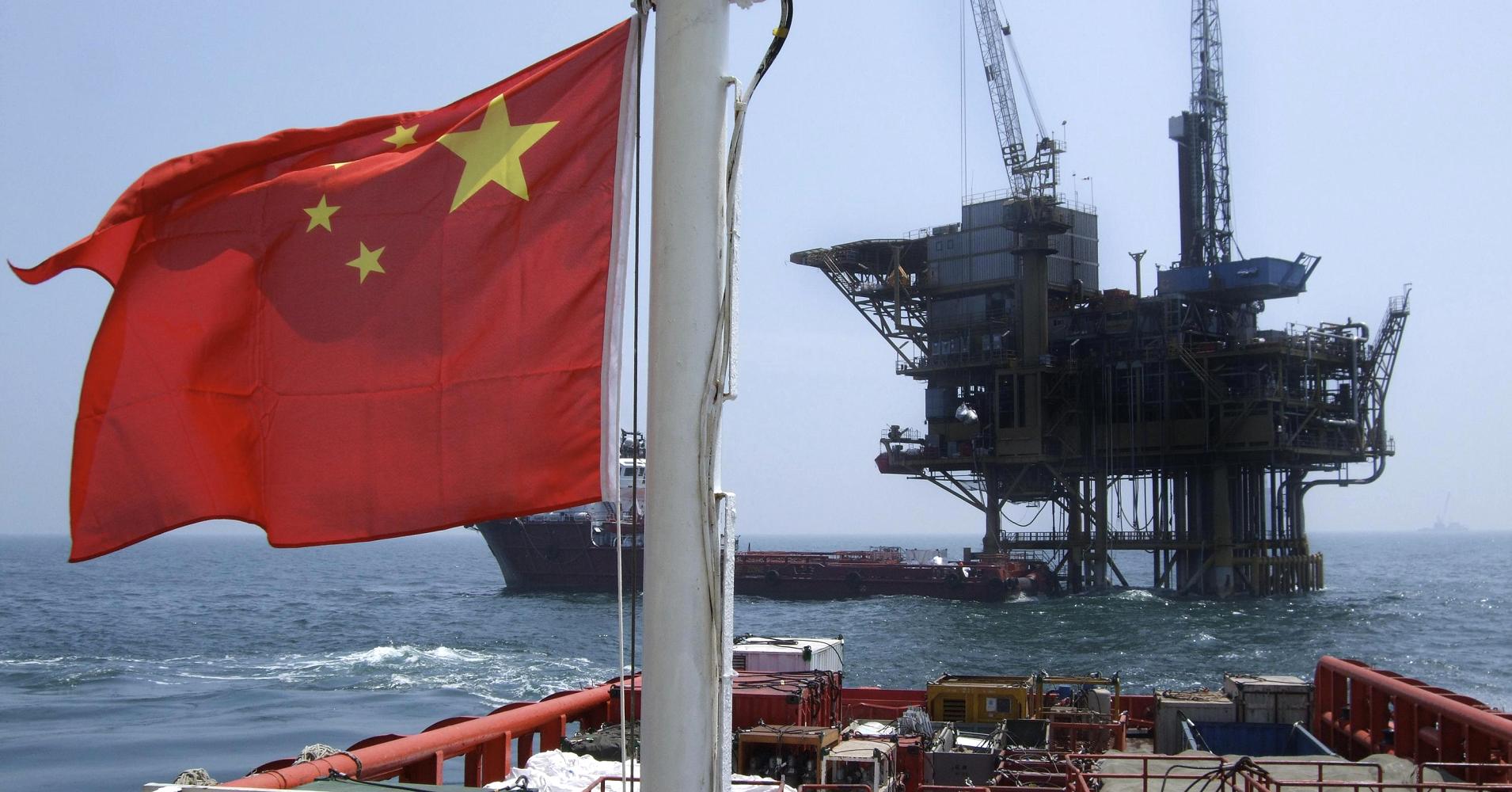

China’s Oil and Gas Realities

The respective impacts of evolving oil and gas market realities on thinking in Beijing could be considered two sides of the same coin. Investments in both markets are driven by China’s desire to increase its sense of energy security and involve a complex network of regional and global ties that will inevitably lead the country to expand its geopolitical reach. Yet the particulars of oil and gas markets also affect China in very different ways.

On the oil side, the rapid pace and enormous scale of China’s oil demand and import growth have been a central driver in global oil markets and the geopolitics of oil. China has been one of the major factors behind rising global oil prices and heightened concerns among large importing countries over a potential future of very tight and precarious oil supplies. Meanwhile, oil has also been a key driver of China’s emergence outward as a regional and global power. This is largely because the country’s buying power and enormous new oil investments are inevitably accompanied by efforts to strengthen diplomatic ties with major energy suppliers and countries where China’s national oil companies (NOC) have large investments. Hence, the outlook for oil demand in China is inevitably interlinked with its regional and global outlook and thus has important implications for global energy markets and geopolitics.

Alternatively, China has been a much more modest factor in regional and international natural gas markets up until the last five years. However, the country’s traditionally limited interest in gas supplies is rapidly changing. China has discovered natural gas both as a cleaner domestic alternative to environmentally damaging coal use and as a source of supply diversification that can strengthen energy security. Beijing has ambitious plans for the development of its own domestic gas supplies, but as Damien Ma and others have noted there are significant limits on the near-term potential of these projects.1 For example, the government has recently revised downward its ambitious 2020 targets for domestic shale gas production, while raising targets for the consumption of natural gas and its share of overall energy use. Beijing’s intensifying push to enhance the role of natural gas in China’s energy mix is leading rapidly toward increased reliance on large-scale natural gas imports. As China boosts pipeline gas imports from Central Asia and looks to Russia, Australia, Qatar, and other countries in the Middle East to secure future supplies, this quest is further raising the diplomatic profile of China in regional and global energy markets as it is pushed to develop and deepen its international ties.

Three important similarities can be observed from this overview. First, despite the fact that China has substantial domestic oil and gas resources, the outlook for its consumption needs for both fuels will increasingly outrun what can be domestically produced. Second, the scale of China’s potential impact on international markets is enormous, with this impact already being felt in oil markets and likely to grow in the near feature for gas markets. This suggests that China’s energy needs will be an important consideration not only for policymakers in Beijing but also increasingly for leaders in Washington, Tokyo, and Doha. Finally, as will be discussed below, there is a complex interrelationship between China’s market needs for oil and gas and the country’s strategic and political relationships in the Asia-Pacific and other regions. Thus, with these points in mind, the following sections explore China’s oil and gas prospects in greater detail, before drawing broader conclusions for both.

China’s Oil Prospects

As suggested above, China’s oil demand outlook is strongly connected to its regional and global strategic outlook. China has been the most important source of growth in global oil demand over the last decade as a result of industry expansion, urbanization, and motorization.2 Between 2000 and 2012 the country was responsible for over 40% of growth, having added roughly 5 million barrels per day (mmbd) of new demand to the global oil market. To put this in relative terms, China contributed an amount of demand growth equivalent to more than the annual oil consumption of Japan, the world’s third-largest oil-consuming nation.

This powerful growth in oil demand, combined with relatively modest growth in domestic oil production, led to a rapid expansion in dependence on imported oil. Between 2000 and 2012, China’s imports of oil quadrupled, increasing from 1.5 mmbd to 6.0 mmbd. Meanwhile, its import dependence rose from 31% to 60%.3 To find sources able to meet this need, China has seen its dependence on Middle East supplies rise to 50% of the country’s oil imports. Additionally, maritime supplies now account for over 80% of China’s oil imports, with supplies transported through the sensitive sea lanes of the Indian Ocean, Malacca Strait, and South and East China Seas, among other routes.

Revisiting Self-Sufficiency in a Global Context

For Chinese policymakers who have traditionally been focused on self-sufficiency as a critical aspect of energy and resource security, rapidly rising import dependence has had a cathartic impact on Beijing’s policy orientation. In the early 2000s, China’s grudging recognition of its inevitable reliance on global markets drove a “go out” strategy of supporting the global expansion of the three Chinese NOCs to increase the country’s role and influence in the development of supplies. The large investments in oil fields abroad, combined with new crude supply contracts with all the major oil exporters, drove China’s growing presence across the energy export world. Supported by ample financing by state banks and an active energy diplomacy, China and its NOCs have become a larger factor in the Middle East, Central Asia, Africa, South America, and North America.

This strategy has also brought new challenges and entanglements for China and its NOCs. Attempts to invest in the U.S. oil patch have been highly charged politically and added to bilateral tensions. The attempt by the China National Offshore Oil Corporation (CNOOC) to buy Unocal in 2005, for example, led to a firestorm of controversy in Washington, D.C., and ultimately the withdrawal of the offer. Even in 2012, there was significant political concern when CNOOC acquired some operations in the United States as part of its acquisition of Canada’s Nexen, and the investment was only approved with important limitations on CNOOC’s U.S. activities. Meanwhile, Chinese investments in a number of “pariah states” in the Middle East and Africa have drawn Beijing into unwanted diplomatic disputes, attracted criticism, and exposed China to political violence and instability that have threatened its investments and the safety of Chinese citizens. When the Libyan uprising led to widespread and worsening violence, Beijing organized the evacuation of 35,000 Chinese nationals. Finally, heavy dependence on maritime oil supplies flowing through the Malacca Strait and the South China Sea exposes China’s energy lifeline to the naval power of the United States. This is something that Chinese planners view as a potentially critical vulnerability if there were ever a military confrontation between China and the United States. Thus, they see the dependence on sensitive sea lanes as a potential source of unintended tension that must be managed.

Oil in China’s Energy Mix through 2040

Looking forward, Beijing’s oil-driven influence and supply dilemmas both seem likely to intensify. China already surpassed the United States in 2013 as the world’s largest net oil importer, although most forecasts suggest that China’s oil demand growth will slow somewhat as the Chinese economy is gradually reshaped toward a consumer-driven economy. However, while demand growth is expected to slow to 3%–4% annually (nearly half the previous rate of 5%–7%), oil consumption is still expected to rise overall. Between 2013 and 2035, oil consumption is projected to increase from 10 mmbd to 16–17 mmbd, with motorization taking over from industry as the driver of oil demand growth.4 As of 2014, China is already the world’s largest light-duty vehicle market by annual sales, and despite a range of recent policies intended to slow the growth of motorization and steer consumers toward more fuel-efficient vehicles, gasoline-driven oil demand continues to rise strongly.5 Looking ahead to 2040, Japan’s Institute of Energy Economics forecasts that China’s light-duty vehicle fleet is likely to increase nearly fourfold, from 94 million in 2011 to 363 million in 2040.6

While domestic oil output may grow modestly, almost all of China’s incremental oil consumption will need to be imported to respond to the phenomenal growth described above. This suggests that by 2040 China’s dependence on oil imports will rise to roughly 70%, with imports reaching 12–13 mmbd.7 At least two-thirds of these import needs will likely be met by maritime supplies and at least half will come from the Middle East.

To the extent that China remains on this trajectory, oil demand growth seems likely to boost its impact on oil markets. Such growth will inevitably drive China to enlarge its presence abroad, accelerating the country’s emergence as a regional and global power as it purchases, develops, and invests in new supply options. This trend will also intensify diplomatic dilemmas and challenges, as it encourages China to expand its diplomacy in the key energy-exporting regions of the world—most importantly in the Middle East but also in Central Asia, Africa, South America, and even North America. Equally important, the geographic regions supporting this growth suggest that China’s quest for oil will also be a key factor in Sino-U.S. relations as each side bumps up against the other in pursuing its energy security and strategic goals. The Middle East and Persian Gulf will potentially be a key area of either cooperation or competition. China will also become an increasingly important factor in global energy governance due to the scale of its impact and reach. In all these ways, the country is becoming simply too big to stand on the sidelines.

A New Golden Age for Gas?

Natural gas has historically constituted a very small share of China’s energy mix, which has been dominated by coal use in the power sector. As recently as five years ago, natural gas made up just 4% of total energy use, whereas coal constituted two-thirds.8 But as energy security has moved up the strategic agenda of the Chinese leadership at the same time that air pollution and carbon emissions, largely driven by coal and electricity consumption, have become critical issues, the role of natural gas in China’s energy mix is changing. The environmental and strategic benefits of expanding natural gas use have become profoundly clear to policymakers and leaders.

With policy support, China’s gas consumption nearly doubled in a period of four years, rising from 80 billion cubic meters (bcm) in 2008 to 144 bcm in 2012. Gas now makes up 7% of China’s energy mix, which, while still a very low share compared with countries in other regions of the world, is nearly double what it was five years ago.9 Gas-fired power generation is now being encouraged in regions where gas supplies are available as a way to slow growth in coal consumption and reduce air pollution. This is the case around major cities in the east that have natural gas infrastructure and also along the route of three large natural gas trunk lines running from west to east. These three major pipelines have been built to bring gas from western China to the eastern coastal cities and will enable expanded access across the country. Domestic gas production has also grown substantially, increasing by 33% from 2008 to 2012 to reach 107 bcm, but consumption has rapidly outrun production. As a result, China has witnessed rising gas imports, which accounted for 25% of its gas use in 2012.10

China’s Dash for Gas

China is thus engaged in a major “dash for gas.” Plans to rapidly increase gas consumption to reduce environmental pressures mean that gas imports will continue to grow, which will produce rippling effects through regional markets. China’s 2011 natural gas plan targeted consumption to essentially triple from 107 bcm in 2010 to 220 bcm in 2015 and 330 bcm by 2020. In mid-2014 the target for 2020 was raised to 420 bcm, which would constitute an astounding fourfold rise over just ten years.11

While domestic gas production is also forecast to rise strongly, much of the expected incremental demand still will need to be met by imports because of limits on domestic options. China is on target to raise its domestic conventional and unconventional gas production substantially, but the outlook remains unclear due to uncertainty about long-term supply development and domestic pricing for gas. Although China potentially has the world’s largest shale gas resources, developing those resources will require successfully navigating a complex geology, continuing technology development, making major investments in new pipeline infrastructure, and addressing a range of other near-term barriers. With the higher 420 bcm target for gas use in 2020, imported gas will likely constitute 40%–50% of China’s gas use by 2025, depending on developments in domestic gas production.12

With this in mind, China has developed a robust and diversified set of potential sources to meet growing demand for gas imports. First, three large pipelines have been built from Central Asia to bring supplies of Turkmenistan gas to China’s western border and on to eastern markets, and a fourth pipeline is planned. More gas from Kazakhstan and Uzbekistan will be added to expand the volumes provided by these four pipelines. Current plans are for 65 bcm of gas to come from Central Asia to China by 2020, with potential expansion to as much as 100 bcm. Second, a new gas pipeline has been built to bring 12 bcm of gas from Myanmar to southern China. Third, China now has seven LNG receiving terminals along its east coast, and many others are planned, which could raise LNG imports to 60–70 bcm by 2020. Finally, after a decade of negotiations, Russia and China signed a gas pipeline deal in May 2014. The deal will bring 38 bcm of gas from the Russian Far East to northeastern China by 2023, further diversifying the country’s imported gas options.

Such developments and the huge expansion in Chinese gas imports are already beginning to have important impacts on Asia’s regional gas trade, LNG markets, and gas pricing. China has now become a major factor in potentially knitting together Eurasia’s fragmented gas trade as the country draws in large supplies from Central Asia, Russia, and Myanmar. Eventually these overland supplies could meet imported supplies of LNG along the Chinese coast and become the fulcrum of gas pricing across the region. LNG suppliers and developers in Qatar, Australia, Russia, offshore East Africa, and even the United States and Canada are expecting large-scale Chinese LNG imports to help support Asia’s high, oil-linked LNG prices in the future. Alternatively, competition for a place in the Chinese gas market could be a key driver reducing Asia’s high LNG and pipeline gas prices. In a decade, China could rival Japan as the largest LNG importer in the world.

China’s Emerging Geopolitics of Gas

Geopolitically, China’s increasing presence in gas markets is leading the country to expand its diplomacy and development efforts across Eurasia. Enormous gas imports from Central Asia, for example, are reinforcing China’s influence in that region. The quest for new gas supplies also provides a foundation for closer relations with Russia by supplying an outlet for Russian Far East gas and creating a base load of demand that makes LNG and other pipeline gas exports from the Russian Far East to Northeast Asia more commercially viable. Another gas pipeline to western China based on existing West Siberian gas supplies also appears to be in the works.13 In the wake of U.S. and European sanctions and pressure to reduce dependence on Russian gas amid the Ukraine crisis, the pipeline agreements with China give Russia a key alternative market for its gas, add gas-export revenues, and allow President Vladimir Putin to boast that Russia has other options for its energy exports. But the agreements are a double-edged sword. China’s forays into Central Asia have substantially reduced Russian control over Central Asian gas supplies (specifically in Turkmenistan) and eroded Russia’s influence in the region.

Hence, natural gas has become a key ingredient in China’s energy security calculus as well as an important element of efforts to diversify its energy mix and move the country toward a more environmentally sustainable future. Domestic gas production is expected to rise strongly, although the pace and scale of growth inevitably remain uncertain. Huge domestic shale gas resources could significantly change China’s energy outlook, but over a longer time horizon beyond 2020. In the meantime, gas is becoming a key factor in China’s growing regional and global geopolitical footprint in ways similar to the impact of oil on the country’s geopolitics.

Key Questions for Policymakers

China’s growing imports of oil and gas supplies have significant implications both for regional markets and for geopolitics. Oil and gas investments abroad by Chinese NOCs, oil and gas supply contracts, oil-backed loans, pipeline connections to Central Asia and Russia, and the imperative of protecting Chinese citizens on the ground all will drive China’s diplomatic presence in key regions. This means that China will occupy more and more strategic space currently occupied by the United States. As one example, the two countries will increasingly bump up against each other in places like Iran, Saudi Arabia, and Iraq as a result of China’s quest for oil.

For both the United States and China, this outlook raises a number of increasingly important questions. Will the two countries manage their intersecting interests cooperatively or competitively? Can the United States and China find common ground on managing political challenges and instability in the Persian Gulf? Another key question is whether the relationship between China and its NOCs will continue to follow the mercantilist model of “China Energy Inc.” or evolve into a more market-driven approach that might reduce the diplomatic sensitivities and complications that tend to accompany the overseas investments of Chinese NOCs. Each of these questions has implications for geopolitics in key oil-exporting regions as well as for Sino-U.S. bilateral relations.

In addition, China’s growing dependence on maritime oil supplies will also be a “multiplier” in animating Chinese leaders’ interests in territorial claims in the South and East China Seas, where there may be substantial oil and gas resources. It will also increase attention to questions related to the control of Asia’s vital energy sea lanes. These issues are already highly contentious, and the heightened focus on them will bring with it new questions as well. Can the United States and China find common ground in securing the energy sea lanes that will be vital to China’s economic prosperity and that are also key to U.S. efforts to ensure reliable flows of oil to global markets and stable oil prices? Related to this question, how will China approach the broader issue of global energy governance? Beijing has been cool so far to the idea of an association with the International Energy Agency (IEA). It sees the IEA as a U.S.-dominated group reflecting Western and U.S. interests rather than those of new oil importers like China and India. There are indications that Beijing may prefer the idea of global energy governance through the Group of Twenty (G-20) or regional groupings that exclude the United States, such as the Shanghai Cooperation Organisation. In terms of global energy governance, China is increasingly a central factor in cooperation or fragmentation.

The energy security of China and the broader Asia-Pacific would be strengthened if the United States and China could find common ground on more collaborative ways to ensure reliable access to energy supplies for the region. Stability in the Middle East, secure energy sea lanes from the Middle East to Asia, and more effective global energy governance are all vital interests for both countries. To date, these important public goods have largely been supplied by the United States and U.S.-led institutions. But China is now too big a global energy factor to stand on the sidelines. A partnership between the United States and China would serve Asian and global energy security, but this will require astute diplomacy and a common vision of the energy future.

Conclusion

China’s widening quest for imported oil and gas to meet its enormous future energy needs is accelerating and reshaping the country’s regional and global presence and influence. This search will be a key driver of the growing gravitational force of China’s expanding economic and diplomatic footprint. But it will also complicate Chinese diplomacy and bring new entanglements in places where China has never been involved. In addition, this quest will have large impacts on the future of global oil prices as well as on natural gas and LNG prices in Asia.

This evolution of China’s energy strategy could support greater cooperation with other Asian and Eurasian powers and the United States on more integrated, competitive energy markets and a more productive, multilateral approach to energy security. China’s growing stake in the stability of global energy markets and secure transportation routes should give the country strong incentives to collaborate with other importers and producers on ensuring stable oil and gas supplies and more competitive prices.

However, China’s greater demand for oil and gas supplies also has the potential to lead to competition. If China, the United States, and other major importers and suppliers choose to see energy sea lanes, secure energy supplies, and control of pipeline routes as elements of a nationalistic, mercantilist platform for political and economic competition, there is a significant risk of a zero-sum outcome. The energy diplomacy of both the United States and China and their ability or inability to collaborate will be critical to determining which path is chosen.

Mikkal E. Herberg is a member of the International Expert Panel of MAP and the director of the energy security program at NBR.